Difference between revisions of "ATI - Tata example"

| Line 16: | Line 16: | ||

<br><br> | <br><br> | ||

== Template Exceptions = | == Template Exceptions == | ||

[[File:tata_exceptions.png]] | [[File:tata_exceptions.png]] | ||

Revision as of 09:21, 11 November 2022

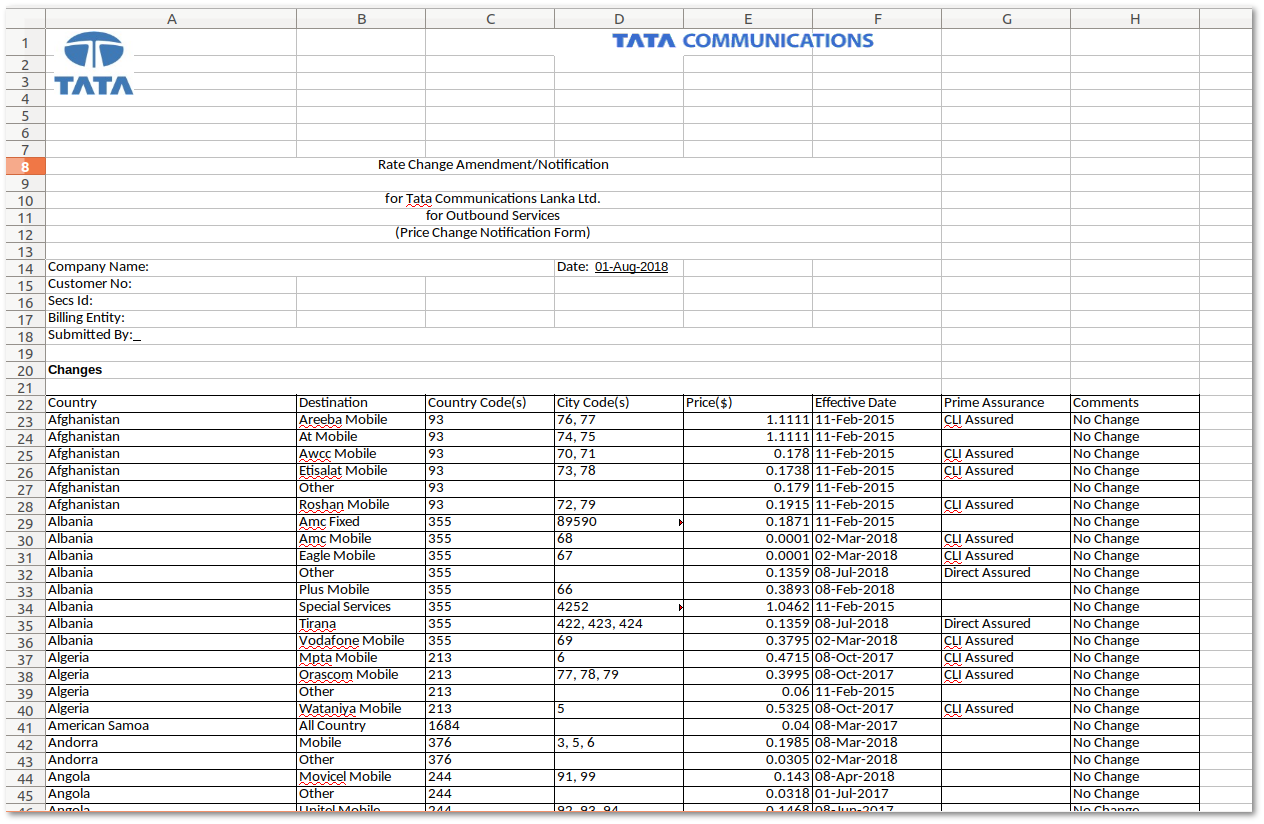

Analyze the tariff

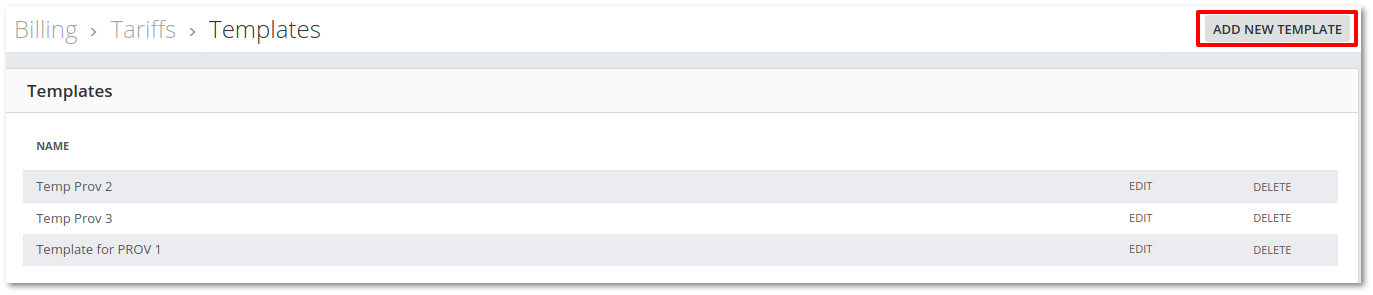

Template

Create a template for a tariff in BILLING → Tariff import → Import Rules → Templates

Select appropriate fields according to the tariff cells:

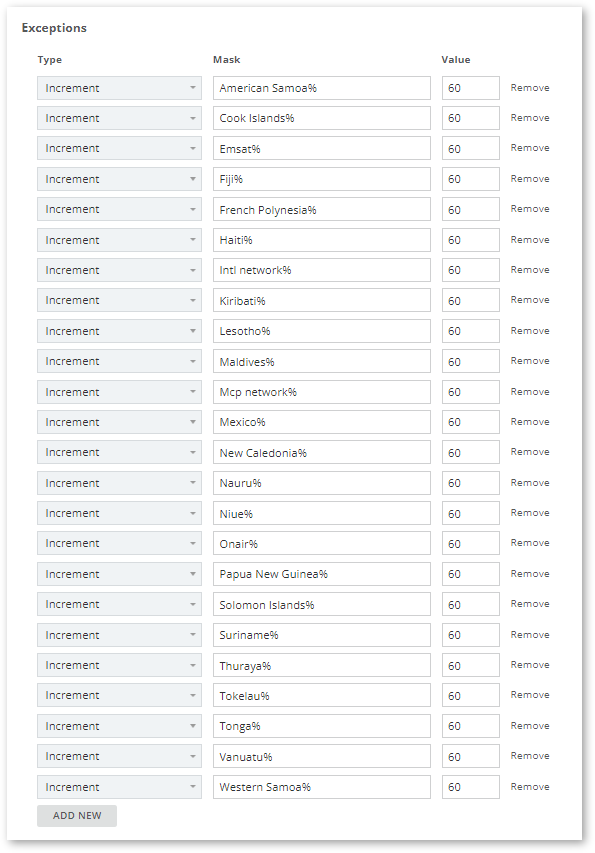

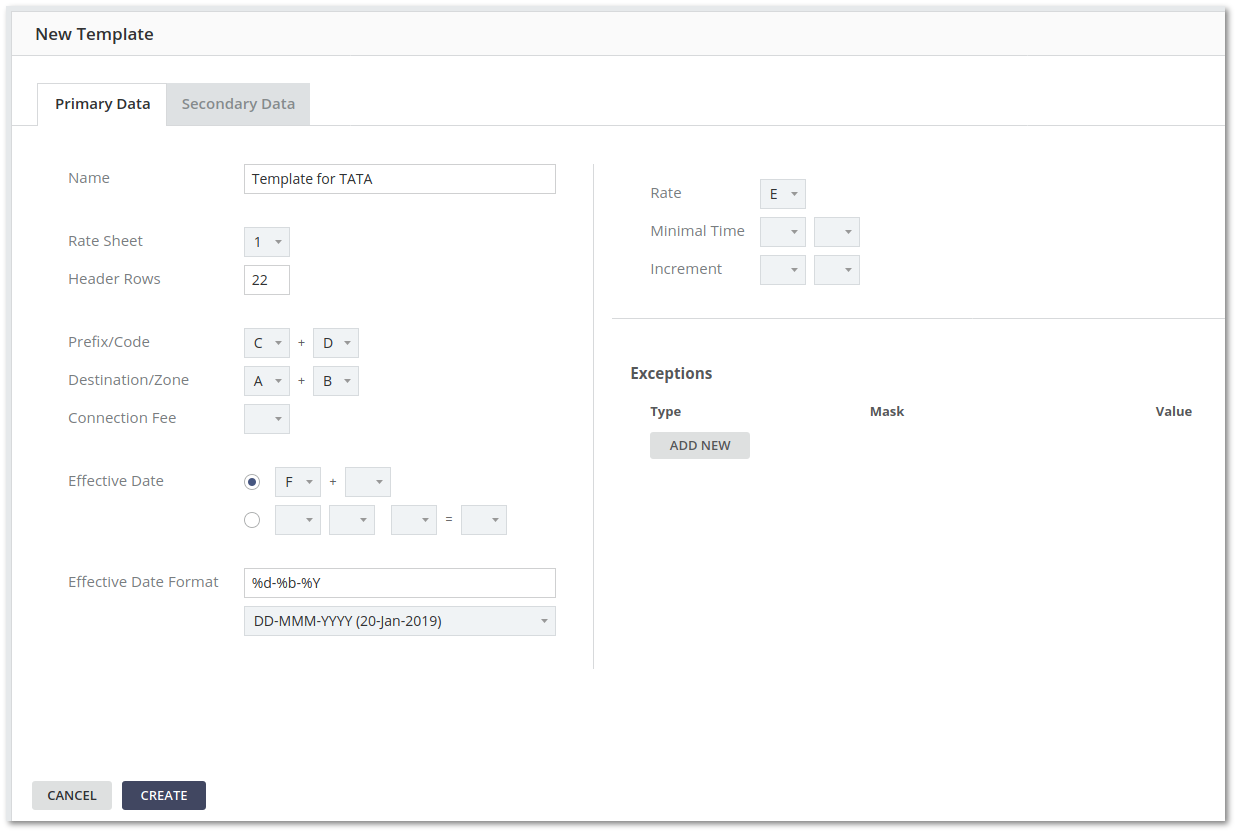

Template Exceptions

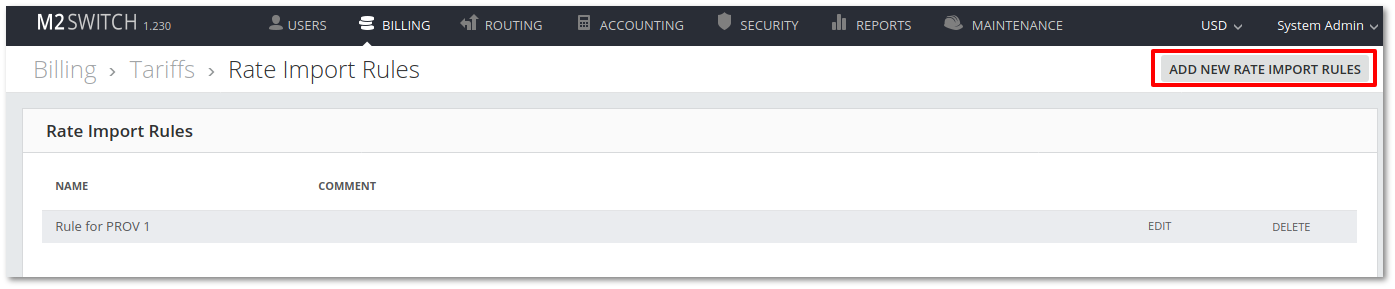

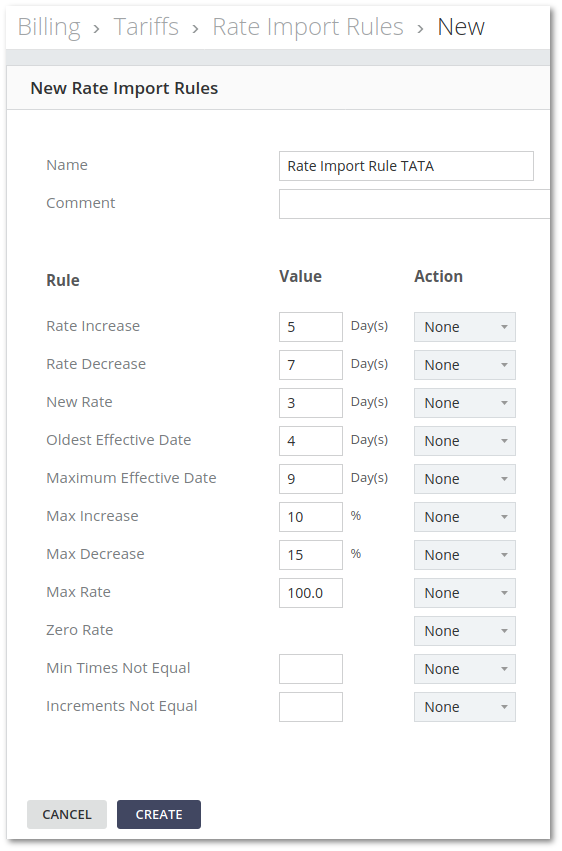

Import Rules

Create Rate Import Rules in BILLING → Tariff import → Import Rules → Rate Import Rules

Fill cells according to your needs:

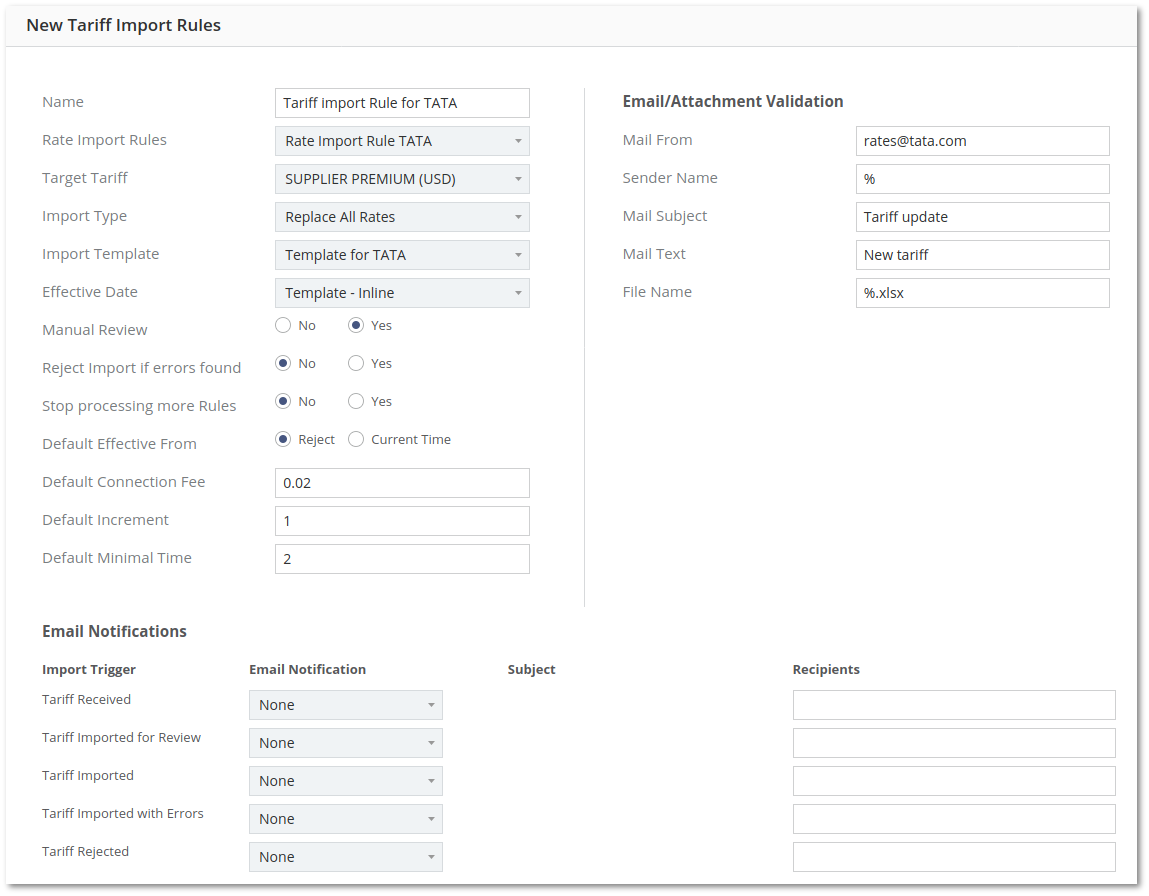

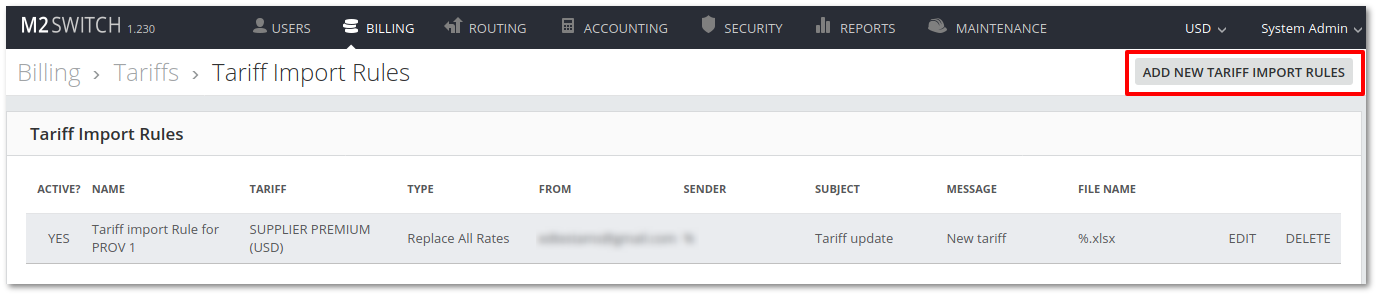

Tariff Import Rules

Create Tariff Import Rules in BILLING → Tariff import → Import Rules

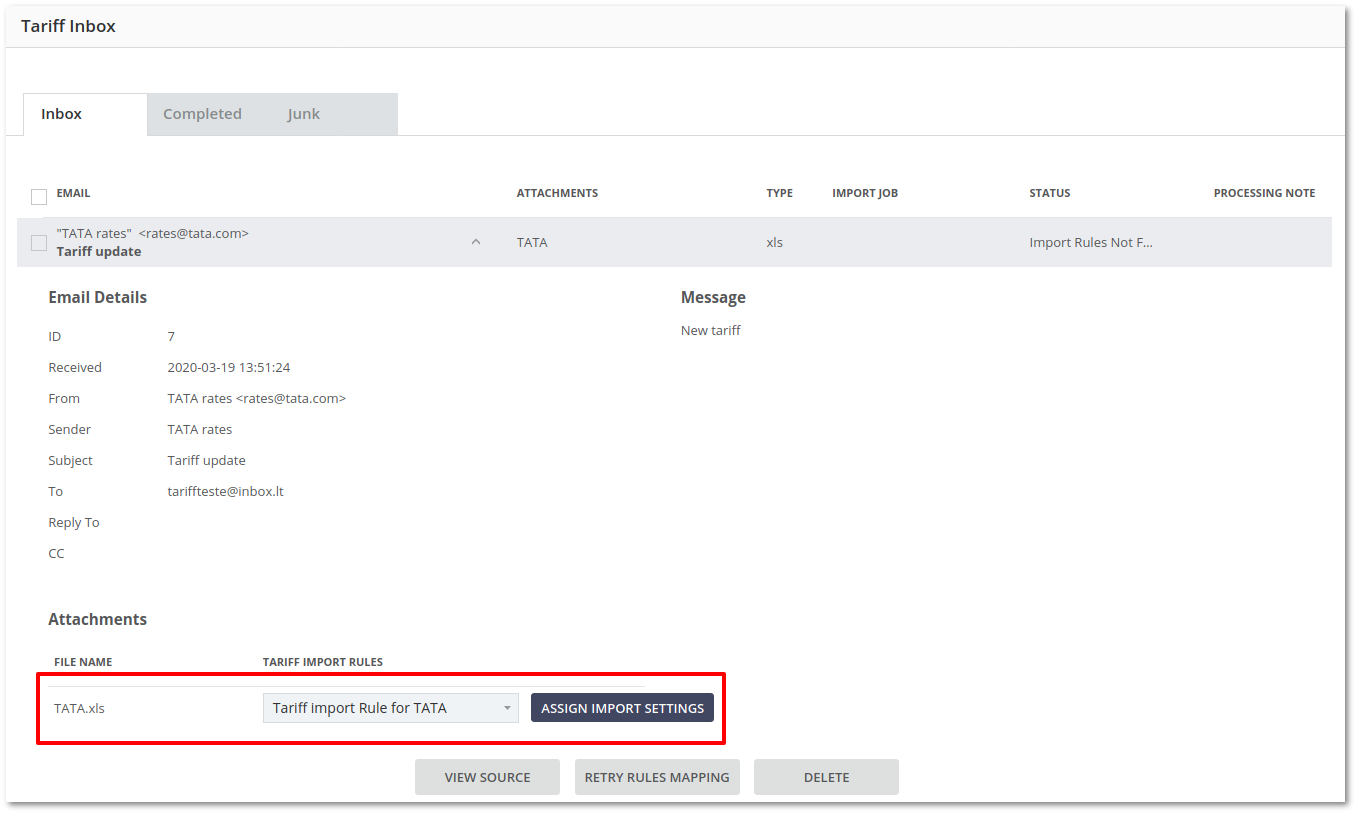

Inbox

Check the Inbox for a new email at Billing → Tariff Import → Inbox

Enter the mail, select Tariff Import Rules, and press Assign Import Settings to continue the import:

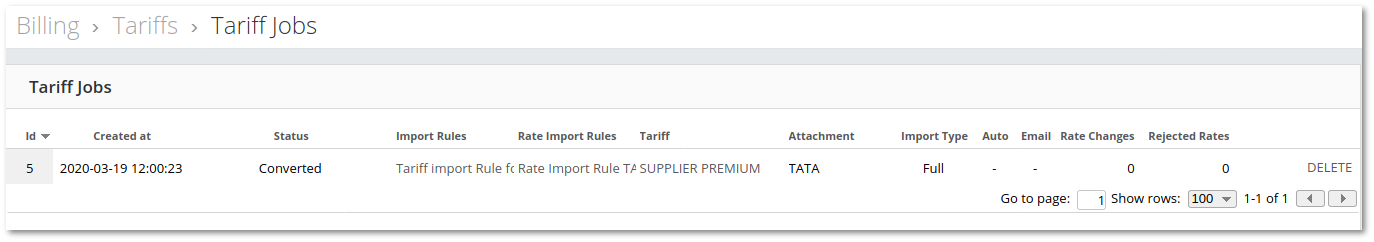

Tariff Job

Tariff job is created now, you can see it in BILLING → Tariff Import → Jobs

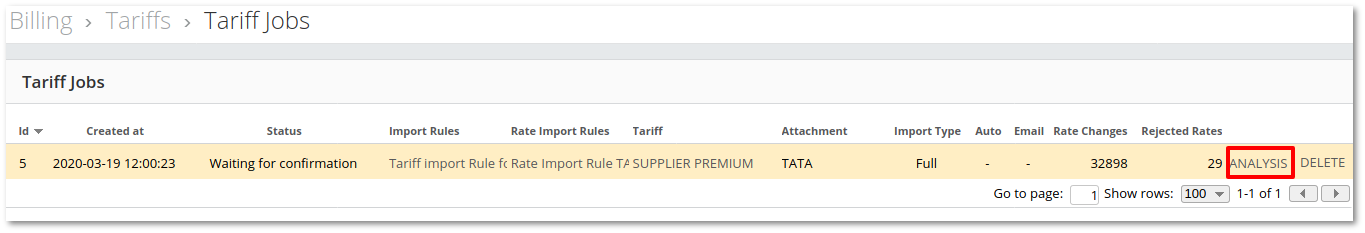

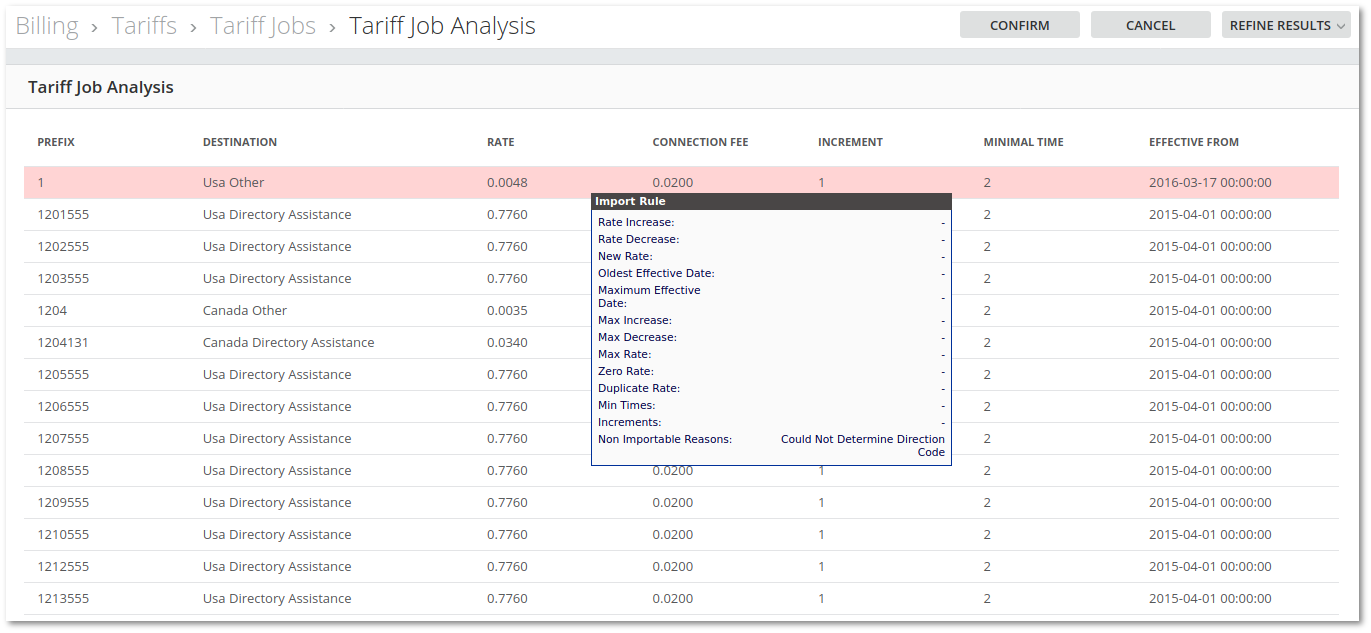

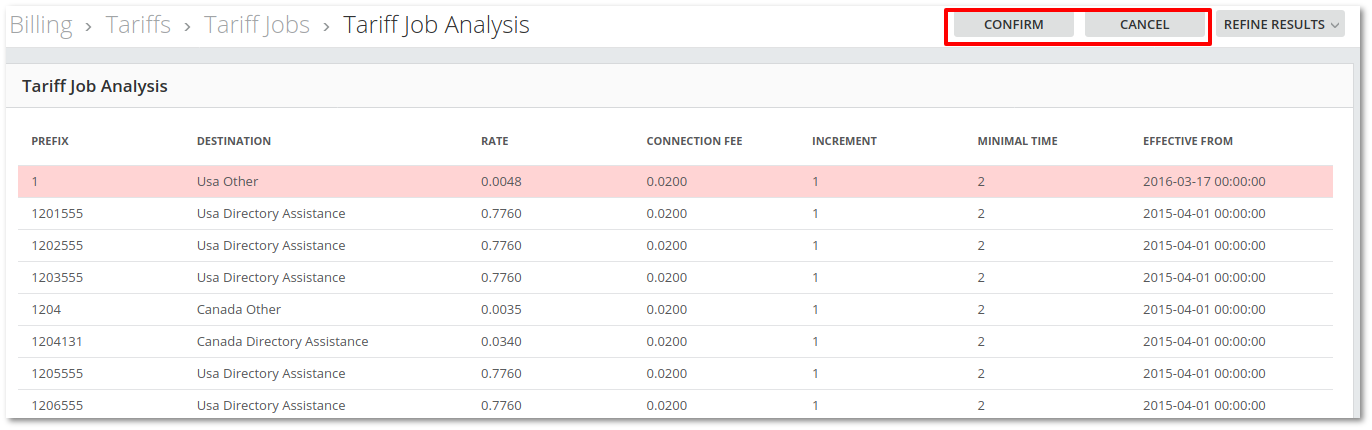

The Job is now waiting for confirmation. You can view the analysis before confirming:

Point to the line you want to analyze to see more information:

If you are satisfied, press Confirm to finish the import procedure, otherwise, cancel it.

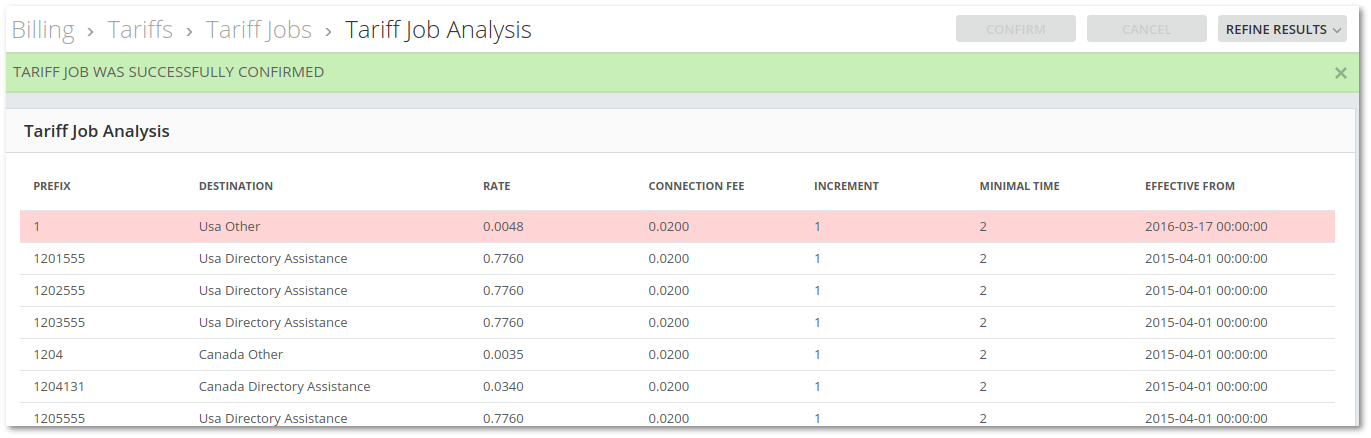

If you pressed confirm, you will see that job was successfully confirmed:

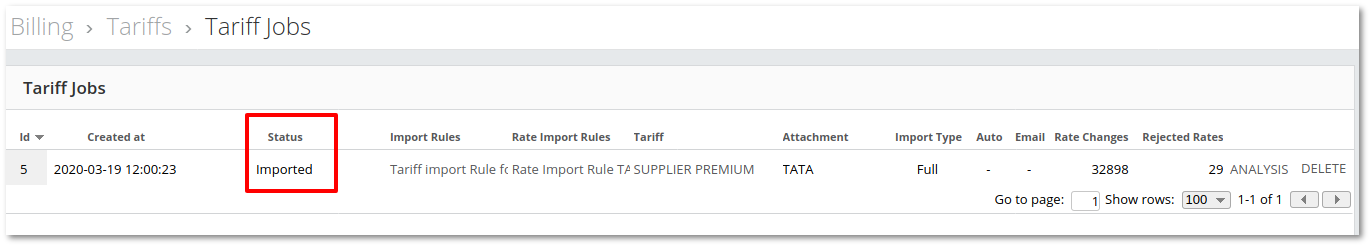

Go back to the Jobs page in BILLING → Tariff Import → Jobs to see the status of the Job:

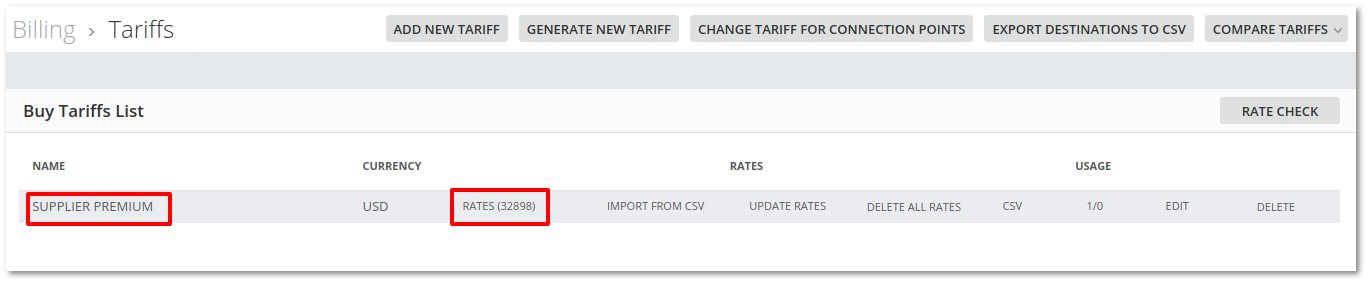

Tariff import is finished. As a targeted tariff in this example was “SUPPLIER PREMIUM”, you can verify rates by checking page BILLING → Tariffs.