Multi-Tax system

This functionality is available from MOR 8

All prices and rates in MOR are without TAXES. That's a rule. Each user has TAX percent. By this TAX percent he gets charged when he makes payments or views his rates.

Multi-Tax system allows to have several taxes in final reports for users.

Compound Tax and Simple Tax

Lets say we have 2 taxes for simplicity A and B. And some amount without tax X.

When it is check Compound tax, multiple taxes are calculated in following way:

Amount with Compound Taxes = (X + A%) + B%

then if Compound tax is disabled then:

Amount with Simple Taxes = X + (A% + B%)

= Example for Compound tax

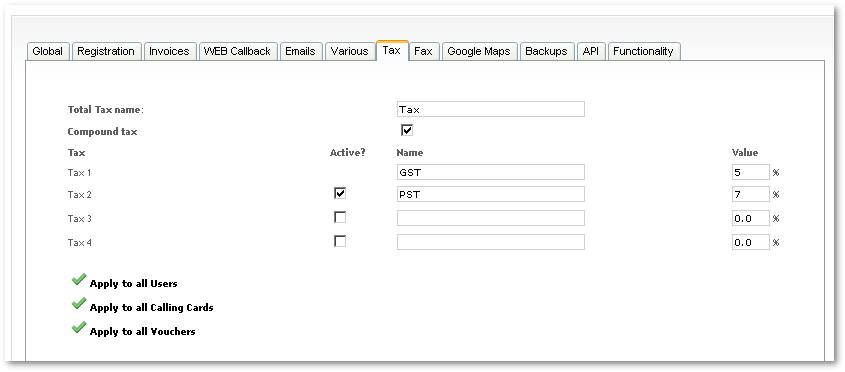

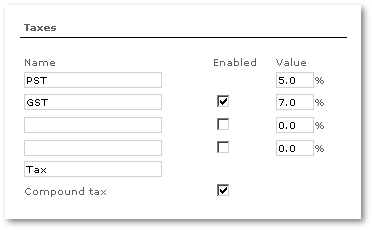

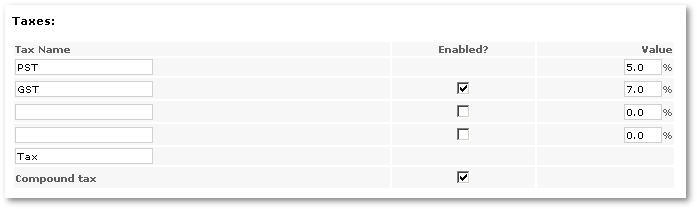

Example for Canada

As example we can take Canada which has GST and PST taxes which should be shown on Invoices/Reports/etc.

Taxes are applied to all newly created Users:

and Calling Cards:

If you changed taxes you can assign this to all Users/Calling Cards by pressing buttons bellow: