Difference between revisions of "Multi-Tax system"

| Line 1: | Line 1: | ||

All | =Description= | ||

MOR allows you to set several TAXes for [[Users]], [[Calling Card Groups]] and [[Vouchers]]. '''All Prices and Rates in MOR are without TAXes.''' That's a rule. | |||

* Each User has a TAX percent. The User is charged by this TAX percent when he makes Payments or views his Rates. | |||

* Each Calling Card Group has a TAX percent it is applied for each Card of concrete Card Group when Card is Sold. | |||

* Each Voucher has a TAX percent it is applied for each Voucher when it is used. | |||

The Multi-Tax system provides for several TAXes in the final reports for Users, for example - [[Invoices]]. | |||

There is two types of Multi-Tax usage: | |||

<br><br> | <br><br> | ||

= Compound Tax | === Compound Tax === | ||

Let's say we have taxes T1, T2, T3 and T4. And some amount without tax, X. | Let's say we have taxes T1, T2, T3 and T4. And some amount without tax, X. | ||

| Line 12: | Line 18: | ||

Amount with Compound Taxes = (((X + T1%) + T2%) + T3%) + T4% | Amount with Compound Taxes = (((X + T1%) + T2%) + T3%) + T4% | ||

'''Example''' | |||

We have initial data: | We have initial data: | ||

| Line 36: | Line 37: | ||

'''Amount with Compound tax = 5.41443''' | '''Amount with Compound tax = 5.41443''' | ||

<br><br> | |||

=== Simple Tax === | |||

Let's say we have taxes T1, T2, T3 and T4. And some amount without tax, X. | |||

If '''Compound tax''' is disabled, then: | |||

Amount with Simple Taxes = X + (T1% + T2% + T3% + T4%) | |||

'''Example''' | |||

We have initial data: | |||

SUBTOTAL 3.99 | |||

TAX1: 18% | |||

TAX2: 15% | |||

Calculating when '''Compound tax''' is disabled (Simple tax): | Calculating when '''Compound tax''' is disabled (Simple tax): | ||

| Line 48: | Line 63: | ||

'''Amount with Simple tax = 5.3067''' | '''Amount with Simple tax = 5.3067''' | ||

<br><br> | <br><br> | ||

= Example for Canada = | = Example for Canada = | ||

| Line 67: | Line 79: | ||

Taxes are applied to all newly created Users: | Taxes are applied to all newly created Users: | ||

<br><br> | |||

[[Image:multitax2.png]] | [[Image:multitax2.png]] | ||

<br><br> | |||

and Calling Cards: | and Calling Cards: | ||

<br><br> | |||

[[Image:multitax3.png]] | [[Image:multitax3.png]] | ||

<br><br> | |||

If you change taxes, you can assign this to all Users/Calling Cards/Vouchers by pressing the buttons below: | If you change taxes, you can assign this to all Users/Calling Cards/Vouchers by pressing the buttons below: | ||

Latest revision as of 13:22, 13 September 2013

Description

MOR allows you to set several TAXes for Users, Calling Card Groups and Vouchers. All Prices and Rates in MOR are without TAXes. That's a rule.

- Each User has a TAX percent. The User is charged by this TAX percent when he makes Payments or views his Rates.

- Each Calling Card Group has a TAX percent it is applied for each Card of concrete Card Group when Card is Sold.

- Each Voucher has a TAX percent it is applied for each Voucher when it is used.

The Multi-Tax system provides for several TAXes in the final reports for Users, for example - Invoices.

There is two types of Multi-Tax usage:

Compound Tax

Let's say we have taxes T1, T2, T3 and T4. And some amount without tax, X.

When Compound tax is checked, multiple taxes are calculated in following way:

Amount with Compound Taxes = (((X + T1%) + T2%) + T3%) + T4%

Example

We have initial data:

SUBTOTAL 3.99 TAX1: 18% TAX2: 15%

Calculating when Compound tax is enabled:

Amount with Compound tax = (SUBTOTAL + TAX1) + TAX2

in digits:

(SUBTOTAL + TAX1) = 3.99 + 18% = 3.99 + 3.99 / 100 * 18 = 3.99 * 1.18 = 4.7082

(SUBTOTAL + TAX1) + TAX2 = 4.7082 + 15% = 4.7082 + 4.7082 / 100 * 15 = 4.7082 + 0.70623 = 4.7082 * 1.15 = 5.41443

Amount with Compound tax = 5.41443

Simple Tax

Let's say we have taxes T1, T2, T3 and T4. And some amount without tax, X.

If Compound tax is disabled, then:

Amount with Simple Taxes = X + (T1% + T2% + T3% + T4%)

Example

We have initial data:

SUBTOTAL 3.99 TAX1: 18% TAX2: 15%

Calculating when Compound tax is disabled (Simple tax):

Amount with Simple tax = SUBTOTAL + (TAX1 + TAX2)

in digits:

SUBTOTAL + (TAX1 + TAX2) = 3.99 + (18% + 15%) = 3.99 + 33% = 3.99 + 3.99 / 100 * 33 = 3.99 + 1.3167 = 3.99 * 1.33 = 5.3067

Amount with Simple tax = 5.3067

Example for Canada

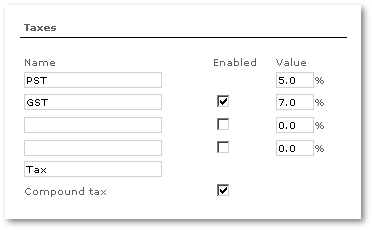

As an example we can take Canada, which has GST and PST taxes that should be shown on invoices, reports, and so on:

- Open SETTINGS –> Setup –> Settings –> Tax

- Enter Total Tax name (i.e. Tax)

- Check Compound tax

- Enter Tax 1 name (i.e. GST) and value (i.e. 5.0%)

- Check Active? near Tax 2

- Enter Tax2 name (i.e. PST) and value (i.e. 7.0%)

- Click Save changes

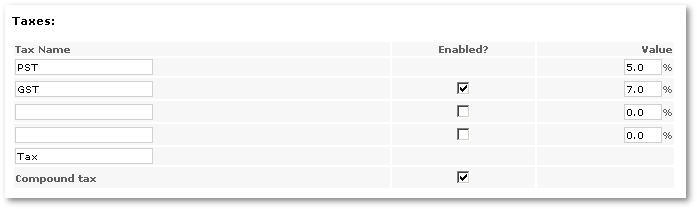

Taxes are applied to all newly created Users:

and Calling Cards:

If you change taxes, you can assign this to all Users/Calling Cards/Vouchers by pressing the buttons below: