Difference between revisions of "Multi-Tax system"

| Line 1: | Line 1: | ||

''This functionality is available from [[MOR v0.8 documentation | MOR 8]]'' | ''This functionality is available from [[MOR v0.8 documentation | MOR 8]]'' | ||

All prices and rates in MOR are without TAXES. That's a rule. Each user has TAX percent. | All prices and rates in MOR are without TAXES. That's a rule. Each user has a TAX percent. The user is charged by this TAX percent when he makes payments or views his rates. | ||

The Multi-Tax system provides for several taxes in the final reports for users. | |||

Multi-Tax system | |||

<br><br> | <br><br> | ||

= Compound Tax and Simple Tax = | = Compound Tax and Simple Tax = | ||

Let's say we have taxes T1, T2, T3 and T4. And some amount without tax, X. | |||

When | When '''Compound tax''' is checked, multiple taxes are calculated in following way: | ||

Amount with Compound Taxes = (((X + T1%) + T2%) + T3%) + T4% | Amount with Compound Taxes = (((X + T1%) + T2%) + T3%) + T4% | ||

If '''Compound tax''' is disabled, then: | |||

Amount with Simple Taxes = X + (T1% + T2% + T3% + T4%) | Amount with Simple Taxes = X + (T1% + T2% + T3% + T4%) | ||

| Line 57: | Line 56: | ||

= Example for Canada = | = Example for Canada = | ||

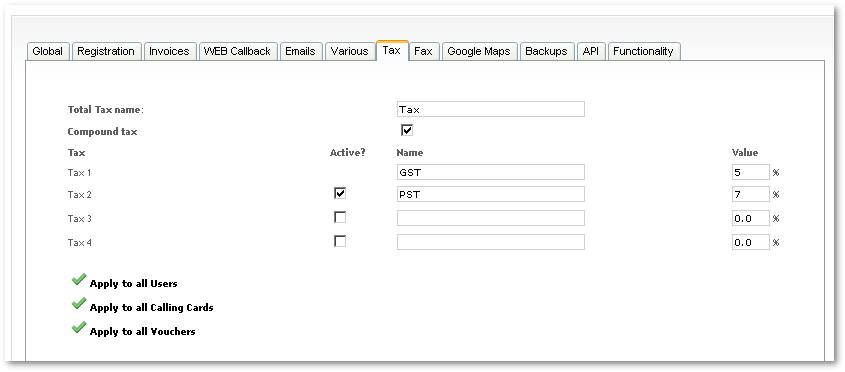

As example we can take Canada which has GST and PST taxes | As an example we can take Canada, which has GST and PST taxes that should be shown on invoices, reports, and so on. | ||

[[Image:multitax1.png]] | [[Image:multitax1.png]] | ||

| Line 73: | Line 73: | ||

If you | If you change taxes, you can assign this to all Users/Calling Cards by pressing the buttons below: | ||

* [[Image:icon_check.png]] '''Apply to all Users''' | * [[Image:icon_check.png]] '''Apply to all Users''' | ||

* [[Image:icon_check.png]] '''Apply to all Calling Cards''' | * [[Image:icon_check.png]] '''Apply to all Calling Cards''' | ||

* [[Image:icon_check.png]] '''Apply to all Vouchers''' | * [[Image:icon_check.png]] '''Apply to all Vouchers''' | ||

Revision as of 13:27, 29 April 2010

This functionality is available from MOR 8

All prices and rates in MOR are without TAXES. That's a rule. Each user has a TAX percent. The user is charged by this TAX percent when he makes payments or views his rates.

The Multi-Tax system provides for several taxes in the final reports for users.

Compound Tax and Simple Tax

Let's say we have taxes T1, T2, T3 and T4. And some amount without tax, X.

When Compound tax is checked, multiple taxes are calculated in following way:

Amount with Compound Taxes = (((X + T1%) + T2%) + T3%) + T4%

If Compound tax is disabled, then:

Amount with Simple Taxes = X + (T1% + T2% + T3% + T4%)

Example for Compound/Simple tax calculation

We have initial data:

SUBTOTAL 3.99 TAX1: 18% TAX2: 15%

Calculating when Compound tax is enabled:

Amount with Compound tax = (SUBTOTAL + TAX1) + TAX2

in digits:

(SUBTOTAL + TAX1) = 3.99 + 18% = 3.99 + 3.99 / 100 * 18 = 3.99 * 1.18 = 4.7082

(SUBTOTAL + TAX1) + TAX2 = 4.7082 + 15% = 4.7082 + 4.7082 / 100 * 15 = 4.7082 + 0.70623 = 4.7082 * 1.15 = 5.41443

Amount with Compound tax = 5.41443

Calculating when Compound tax is disabled (Simple tax):

Amount with Simple tax = SUBTOTAL + (TAX1 + TAX2)

in digits:

SUBTOTAL + (TAX1 + TAX2) = 3.99 + (18% + 15%) = 3.99 + 33% = 3.99 + 3.99 / 100 * 33 = 3.99 + 1.3167 = 3.99 * 1.33 = 5.3067

Amount with Simple tax = 5.3067

Example for Canada

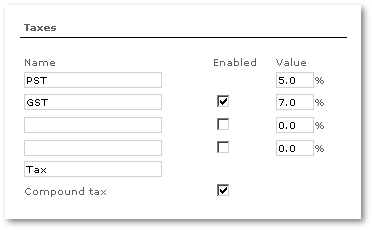

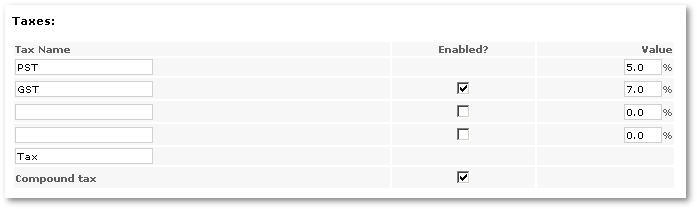

As an example we can take Canada, which has GST and PST taxes that should be shown on invoices, reports, and so on.

Taxes are applied to all newly created Users:

and Calling Cards:

If you change taxes, you can assign this to all Users/Calling Cards by pressing the buttons below: