Difference between revisions of "Multi-Tax system"

| Line 19: | Line 19: | ||

Amount with Simple Taxes = X + (A% + B%) | Amount with Simple Taxes = X + (A% + B%) | ||

== Example for Compound tax = | == Example for Compound/Simple tax calculation== | ||

We have initial data: | |||

SUBTOTAL 3.99 | |||

TAX1: 18% | |||

TAX2: 15% | |||

Calculating when '''Compound tax''' is enabled: | |||

Amount with Compound tax = (SUBTOTAL + TAX1) + TAX2 | |||

in digits: | |||

(SUBTOTAL + TAX1) = 3.99 + 18% = 3.99 + 3.99 / 100 * 18 = 3.99 * 1.18 = 4.7082 | |||

<br><br> | <br><br> | ||

= Example for Canada = | = Example for Canada = | ||

Revision as of 08:19, 8 January 2010

This functionality is available from MOR 8

All prices and rates in MOR are without TAXES. That's a rule. Each user has TAX percent. By this TAX percent he gets charged when he makes payments or views his rates.

Multi-Tax system allows to have several taxes in final reports for users.

Compound Tax and Simple Tax

Lets say we have 2 taxes for simplicity A and B. And some amount without tax X.

When it is check Compound tax, multiple taxes are calculated in following way:

Amount with Compound Taxes = (X + A%) + B%

then if Compound tax is disabled then:

Amount with Simple Taxes = X + (A% + B%)

Example for Compound/Simple tax calculation

We have initial data:

SUBTOTAL 3.99 TAX1: 18% TAX2: 15%

Calculating when Compound tax is enabled:

Amount with Compound tax = (SUBTOTAL + TAX1) + TAX2

in digits:

(SUBTOTAL + TAX1) = 3.99 + 18% = 3.99 + 3.99 / 100 * 18 = 3.99 * 1.18 = 4.7082

Example for Canada

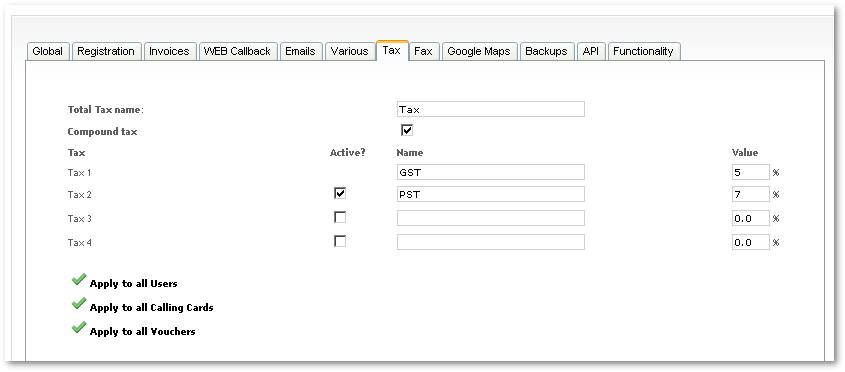

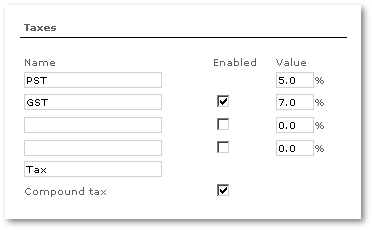

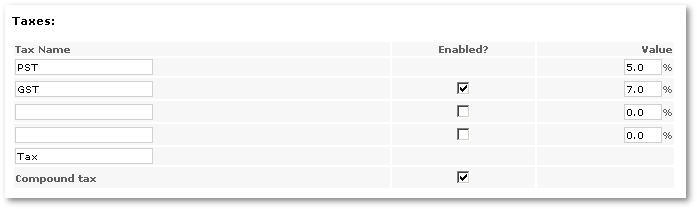

As example we can take Canada which has GST and PST taxes which should be shown on Invoices/Reports/etc.

Taxes are applied to all newly created Users:

and Calling Cards:

If you changed taxes you can assign this to all Users/Calling Cards by pressing buttons bellow: